We are in turbulent times globally and the world has officially entered into a recession that has not been seen since 2008. However this is not unprecedented when we analyse the market conditions from the real estate market perspective. In this post I will share with you how to navigate Singapore' property market if you're looking to buy, sell and invest.

Like all previous cycles, we've been here before

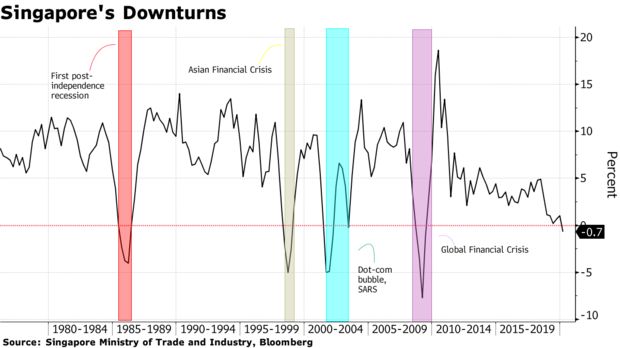

Market booms and busts are almost as certain as death and taxes. Like the many global and regional recessions, Singapore's economy has been here before.

- First recession post-independence

- Asian Financial Crisis

- SARS and the Dot Com Bubble

- '08 Global Financial Crisis

Will this recession be worst than the ones that have preceded? That remains to be seen. However, be sure that the economy will bounce back and recover.

Real estate investing, even on a very small scale, remains a tried and true means of building an individual's cash flow and wealth.

What does that mean for you?

A market downturn is a great opportunity to sell your current property and transit to a larger property a lower price or a property that has a higher potential for capital appreciation.

A good time to sell and buy property?

While it may counter-intuitive, market downturns can be a great time to sell if you're looking to progress or even leapfrog your way up the wealth progression ladder.

Here are 2 common objectives that most home-owners want to achieve and how to do it.

1. Sell to Upgrade to a Larger Unit

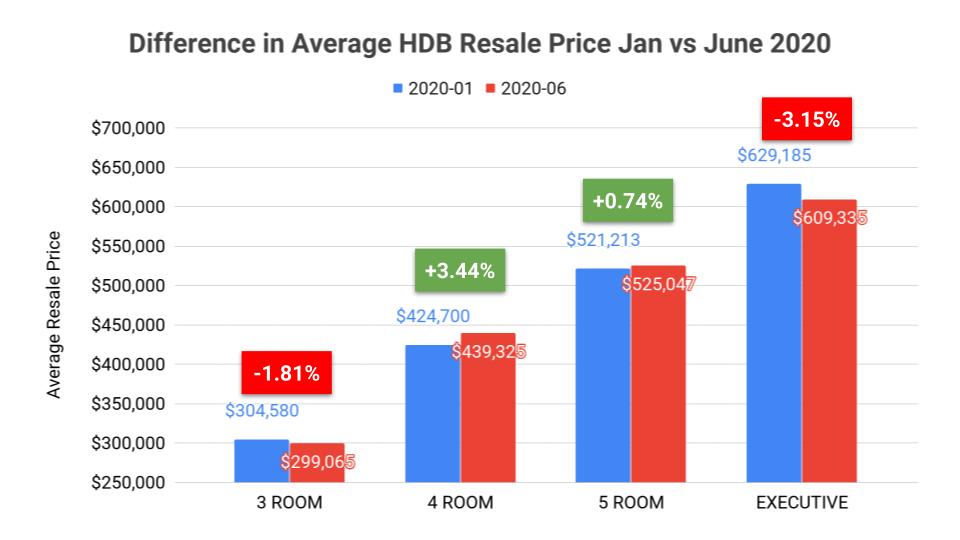

Data Source: https://data.gov.sg/dataset/resale-flat-prices

If you're looking to move to a bigger space from your current apartment this may be a great opportunity to do. Larger apartments experience larger price drops when the market expereinces a downturn compared to smaller units.

Taking a look at the data so far in 2020, 4-Room HDB actually saw a 3.4% increase in June resale price when compared to January. Executive units sees a -3.2% drop in resale price.

With a good strategy buy-sell planned out, you can move to your current smaller unit to upgrade to a larger 5-Room or Executive HDB unit without making a "loss".

2. Buy to Invest in a Once-a-Decade Downturn

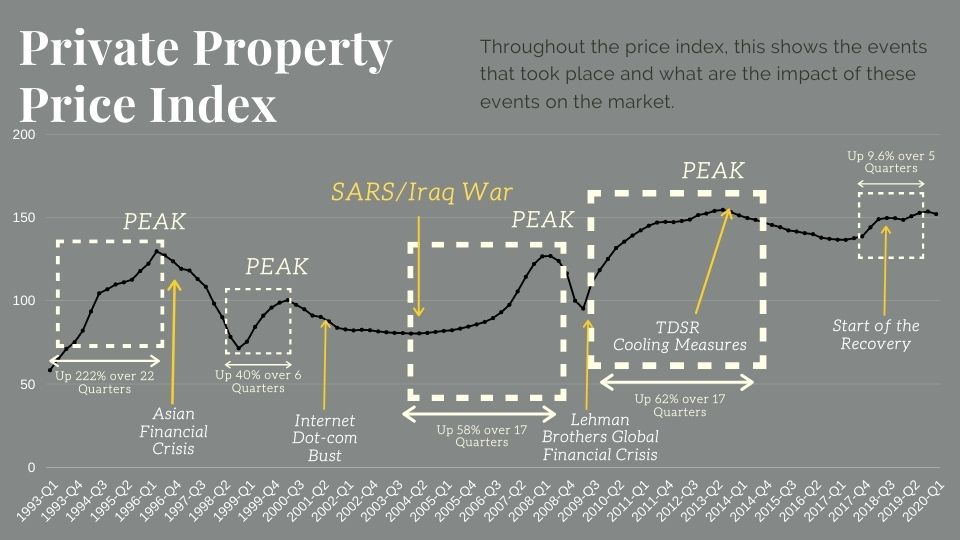

Opportunities arise out of crisis. During the last cycle triggered by the `08 Financial Crisis, saavy investors have been with more than 62% in returns on average over 17 quarters if they went into the market at the right time. Let's take a look at an example.

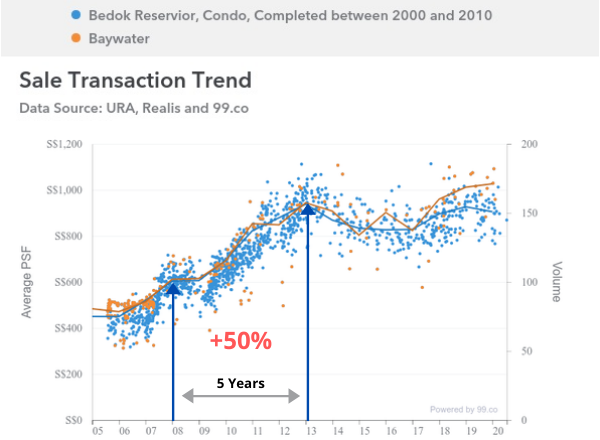

Baywater condominium located at Bedok Reservior TOP in 2006 and a 99-year lease property.

Prices stagnated between 2008-2009 at $600 psf and transaction volume fell drastically during the worst periods of the `08 global recession.

However, over a 5-year period, the property market made a strong recovery and prices peaked at $900 psf in 2013 making a 50% gain.

Identifying a high-potential resale or new-launch private property during a crisis can be the key in growing your investment portfolio massively.

Common Pitfalls and Fallacies to Avoid

This is a Good Time to Find "Good Bargains"

It is a general misconception that developers and sellers will drastically lower prices in a downturn or do quick fire sales.

While this can happen, it is not a common occurrence. Property prices for good location can be very sticky and it is not realistic to expect bargain prices.

However as the market cools you can expect to find good value new launch or resale you can be sure that you're not buying at the "peak" price.

Always Consider Your Opportunity Cost

Most importantly, always consider what you are forgoing when you make an investment decision.

Holding on to your current property now because prices have dropped and you fear that you're losing out by selling at lower price can cost you.

You will potentially forgo the chance to progress to a fast-appreciating property that can potentially reap you much higher returns than the "loss" that you're making right now.

Check out our 21-page guide to real estate investment in Singapore during a bear market

Before you go, download our free guide that provides a detailed look at how to analyse the current bear market based on historical trends and data.

It will help you make a more informed decision on your property. Just fill out the form below and we will mail it straight to your inbox!

Also don't forget to share this with your friends and network if you found it useful!

Download The Bear Market Real Estate Guide 2020