Asset Progression Strategy

Looking to sell your current HDB flat to buy a Condo in Singapore? You need an asset progression strategy.- Book a 15-30 minutes session completely free and find out how we can help you progress your property asset and grow your wealth.

- While the market conditions are tough and uncertain

- Opportunities that you can take advantage of such as low interest rates and new launch discounts

What is Asset Progression?

Asset progression refers the the growing of personal wealth through strategic acquisition of private property.

The end goal is to use property investment as an instrument for you to accumulate wealth to retire comfortably with cash in the bank and also the prospect of passive income through rental revenues.

Is this the right time?

I know you must be thinking, "Property investment during an impending global economic recession? Sure a not?".

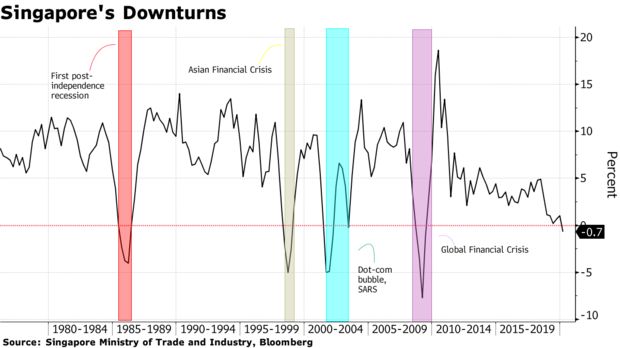

Singapore's property market and economy is historically proven to be resilient and have shown time and again its ability to recover fast and come back even stronger.

Despite the many crises that has taken place in the past:

- First recession post-independence

- Asian Financial Crisis

- Dot Com Bubble

- '08 Global Financial Crisis

Singapore's economy has recovered within 12-18 months and in more recent times out-grown even the previous boom cycle.

Private Property Price Index

Private property price index has historically followed closely with both the boom and bust cycle. With property market showing signs of slow down in Singapore it is a once in a decade opportunity to invest and profit.

How much money do I need to do this?

While the answer will depend largely on the individual, it is often not as much as you would think. Having said that, here is a scenario to illustrate a realistic buyer situation.

Case Study

Jon and Julia, both in their 30s, with a combined income of $8,600 is looking at switching from their 4-room BTO that recently MOP to a new launch development. Their monthly debt amount to about $1,100 and wants to understand how they can make this switch given their current financial position.

| Breakdown | Amount |

|---|---|

| Purchase Price | $1,200,000 |

| Bank Loan | $900,000 |

| Cash Down Payment | $60,000 |

| CPF Down Payment | $240,000 |

| Buyer Stamp Duty | $32,600 |

| Additional Buyer Stamp Duty | $- |

| Legal Fee (Cash / CPF) | $4,000 |

| Total CPF Required | $276,600 |

| Total Cash Required | $60,000 |

By selling their current BTO at $480,000, they were able to progress to a new launch unit in a prime location in the east and have addition cash of over $18,000 to invest in other assets.

That makes sense, but isn't this a bad time to sell off my HDB?

The simple answer is yes, your existing property price will likely be affected by the downturn too. However when making investments I always advise my clients to look at the opportunity cost as well.

HDB resale prices have always been very stable as the government has a huge incentive to ensure that the homes of majority of Singaporeans are subject to big swings of the economic cycle.

Reasons why selling your HDB when prices are down isn't so bad:

- HDB prices are stable - it doesn't grow very much but it doesn't fall a lot either

- While you're not selling at the peak of HDB prices, the potential gains in switching to private is much larger

- You have to also consider the 2.5% CPF interest rates against falling property prices, which could mean that you're potentially not be able to get as much cash when you eventually sell your unit

How do I find out more?

You can reach out me at aloysiusang.era@gmail.com or contact me via my mobile +65 8522 0403. Alternatively, you can book my calender at this link or the form below.

With 30 minutes of your time I will understand your current situation and advise on how to plan out a asset progression strategy for yourself.

SEPTEMBER BONUS

As a time-limited bonus, I have exclusive developer new launch discounts that includes properties in prime location such as Marina Bay, Newton, Tampines, and Eunos districts. Reach out to me to learn more and access these exclusives discounts offered by developer for new launch units while stocks lasts.

How does the booking work?

Just select a preferred timeslot in the form below to book my calendar. A confirmation email will go to your email once complete and I will also drop you a friendly reminder as the date gets closer.

If you're unable to make it at the last minute you can save this link

to access my personal calendar to book another timeslot. No obligation, no strings attached. Feel free to share this with your network!

Just want to have a quick chat and learn more? Call me at my number.

Say Hello

Email. aloysiusang.era@gmail.com

Phone. +65 8522 0403

Find me in

Mountbatten Square

229 Mountbatten Rd, #03-01,

Singapore 398007

Agent Profile

Aloysius Ang

Aloysius is part of the ERA Preeminent Group and founded HomeLedger as an online platform to help

home buyers discover real estate opportunities in Singapore and make informed purchase decisions

based on experience and data.

Service excellence and staying committed to the client's best interest are always the top priorities when it comes to

providing advice to home buyers. He has helped many happy clients transit to their dream home and make

investment decisions that have translated into profits.

License No: R061590D

Mobile: +65 8522 0403

Email: aloysiusang.era@gmail.com

Latest Properties & New Launch